Canada has one of the most efficient cheque clearing systems in the world and, while the use of cheques has been declining with the growing popularity of electronic and card payments, financial institutions in Canada still process nearly a billion cheques every year. A cheque is an agreement of payment between two individuals or organizations. So when you write a cheque, you are agreeing to pay another individual or organization money that you owe them and you are instructing your bank to make that payment.

Here is some helpful information about the use of cheques and how they are processed by financial institutions. All cheques must be processed — or cleared and settled — through the payments system. When you deposit a cheque into your account, your bank will send the cheque to the bank of the person who wrote the cheque. This process can take a few days but, for most cheques, the bank makes the funds available to the customer right away.

Banks are required to provide their hold policies in writing when an account is opened. If your financial institution is currently putting a hold on your cheques, ask if there are alternatives to this hold.

Inland Revenue to stop accepting post-dated cheques from February

In addition, rather than receiving a paper cheque as payment from your employer, the government, or individuals, see if the funds can be deposited directly into your account by direct deposit or ask them to send you an e-mail money transfer: If your bank had given you immediate access to the funds, it will then remove the funds from your account. If you were the cheque-writer, very often your financial institution will charge an NSF fee. You can avoid these fees by ensuring there is enough money in your account to cover the cheques that you write. Sometimes a post-dated cheque is deposited before the date on the cheque.

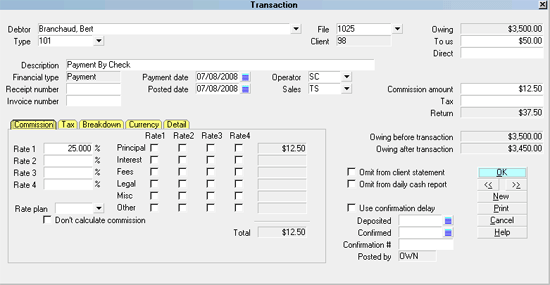

You can help in detecting post-dated cheques that are cashed early. Try to regularly review your transactions through online, mobile or telephone banking or at an ABM. If a post-dated cheque you wrote is mistakenly processed before its date, you should contact your bank to let them know. You can use it backwards, too. If the value of your house, share fund investment or whatever has doubled in eight years, you've earned a 9 per cent return on it.

If it has doubled in just six years, your return has been 12 per cent. What's more, 72 is rather convenient, as lots of other numbers divide evenly into it. I use the 72 Rule often for off-the-top-of-the-head calculations. Investors should be aware of financial markets' cyclical nature, and try to take advantage of this, as there can be, say, a 5-year cycle more or less. The drop in prices for various financial products shares, index funds, trust funds caused by the New York tragedy was an ideal time for people to invest, because investors - including myself - overreact to bad news.

I would say leave your money on short-term deposits until a market downturn occurs, and then transfer cash funds to investment situations.

- Cheques - What you need to know.

- free dating san jose.

- Cheque Holds?

- speed dating penticton bc.

You can't always achieve this, but it is still better than investing your cash somewhere near the top of the market cycle and being locked in at a loss for four or five years. As you say, you must be in for the long term. So why not wait and take full advantage of a market downturn? To quote an article on the same page as yours a few weeks back: You've got one of the messages that I keep trying to hammer home, that investments such as shares must be long term.

Everything you say would be valid if only we knew, at the time, that the markets had hit bottom. To use your New York example, markets plunged right after the terrorist attacks. So why didn't we all rush in to buy shares at bargain prices? Because we worried that prices would drop still further. Your quote about high returns following global crises was just one of many similar messages.

Within days of September 11, we saw graphs showing that the sharemarket rose fast in the year following most other crises. And I'm sure we will all wonder the same thing next time something extraordinarily bad happens.

As for a "five-year cycle more or less", there's so much "more or less" in any share- market cycle that it's useless in helping you try to time your purchases. I agree with you that investing at a time that turns out to be near a market peak is really discouraging. It's all too easy, if you're in and out of markets as you suggest, to miss out on a sudden bull run.

Post-dated cheque

For all we know, world markets might zoom up, starting Monday. They might also plummet. Heaps of research shows that those who get in and out of shares end up worse off than those who go into the market and stay. By far the best strategy is to spread out your purchases, buying regularly once a month or every three or six months, regardless of what the markets are doing.

Latest from Business

If you invest the same amount each time, you benefit from what's called dollar cost averaging. The price fluctuations are rather extreme, but that's just to make it easy to follow. Over four months at that price, you get units.

Over four months at that price, you get 48 units. Over four months at that price, you get 30 units. Over the year, you've bought a total of units.

Without even thinking about it, you've bought more units when they were cheap, and fewer when they were expensive. This works well for regular saving. But what if you've just got a lump sum, perhaps from an inheritance or redundancy money? Because you won't know, until later, whether now is a good or bad time to buy, it's best to spread out your purchases of shares or share fund units. Set yourself a plan and stick to it. You might invest a 12th of the money each month for a year, or a quarter every six months for two years.

Cheques - What you need to know | Cheques - What you need to know

In the meantime, the rest can go into term deposits that mature when you plan to invest them. The same applies if you're getting out of any volatile investment because you plan to spend the money over the next few years. That way, you won't sell everything when prices happen to be particularly low. There has been rather a lot of maths in this week's column.